Financial Controlling @ Anconsult

The Foundations of Financial StabilityAn operational accounting service is your own finance department for your business. Data is processed the way you need it so you can manage and grow your business.

Financial controlling is the key to a healthy and profitable business. Tax compliance is a by-product when these two things work together effectively. To build a strong business that can withstand a turbulent marketplace, you must first build solid foundations.

What Is Financial Controlling @Anconsult?

For your business to grow, you need to know the health of your business at all times.

In the past, the technology wasn’t available to do this. Business data was inadequate and irregular, making it difficult to adjust and improve before it was too late.

Now, with IA and better software, Financial Controlling @ Anconsult can give you regular, high-quality data on what’s happening in your business.

How It Works

When you implement our system into your day-to-day bookkeeping, you get fortnightly reports that tell you how you’re performing and what issues may be looming.

You get the information you need in almost real time, so you can make adjustments and decisions about your business quickly.

Our financial controlling services go beyond data entry and ATO compliance! Operational accounting keeps your business running like a well-oiled machine:

- We manage all your finances, ensuring your accounting records are correct and reports are relevant.

- We set up a customised accounts system for you that captures, analyses and reports your business’s financial information – in a way that makes sense to you.

- We give you regular and accurate data about your business’s health: how it is performing, where you can improve and what actions to take next.

Advantages of Great Financial Controlling

- No bill shock – regular expense monitoring alerts you if an expense hasn’t been paid

- Reduced software costs – an optimised workflow means you don’t pay for anything you won’t use

- Reduced tax agent costs – your books are always reconciled

- Regular cash inflow – your invoice payments are automated

- Reduced bill stress – unpaid supplier payments don’t build up

- Better prices – your good credit rating and improved supplier relationships give you leverage to negotiate pricing

- No surprises – you expect and are prepared for all payment orders

- Confidence with new suppliers – you know you can afford repayments on new contracts

- More choice in purchasing – you can buy equipment outright for better prices.

Operational Accounting Services

Accounting System

We set up your business accounts in a format that’s relevant for your industry to help you easily understand your business’s financial position.

Accounts Payable

We use the latest machine-learning technology to capture all your bills and receipts in real time. This helps keep your payables accurate and helps you stay on top of bills. You’ll pay suppliers on time and keep cash flow in check.

Invoice Management

We set up an invoice processing system that talks directly with your accounting system and processes invoices with speed and accuracy.

Payroll

We set up a time management system that integrates with your accounting process to reduce costs and help you manage payroll effectively.

Accounts Receivable

We provide options for your customers to set up direct debits, payment plans and future payments to help you get paid faster.

Reporting

We give you accurate financial information about your business in a range of fortnightly and monthly reports that are easy to understand.

The Right Information at the Right Time

Your quarterly and annual reports don’t tell you how you’re going throughout the year. It’s too late by the time you get them. There are huge benefits to getting the right information at the right time.

But why is this important?

Let’s look at some of the things your business can benefit from when you are getting the right information at the right time.

Managing Your Costs

Do you know how easily your labour costs can blow out for a full financial year? It takes only 2 excess hours of labour per day to have $20,000 a year in unnecessary labour costs.

If you could see your labour costs every fortnight, you wouldn’t find out when it’s too late. You could take action.

We implement systems that identify any ballooning costs and help you pop them, giving you more time to work on your business.

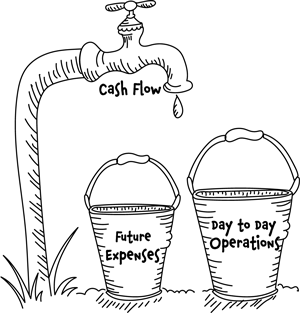

Managing Your Cash Flow

Small business owners have many suppliers and moving parts. They’re making money, but it’s going in and out so often that they don’t feel in control, and aren’t sure if they can pay their bills.

We set up accounting systems and reports that consider these expenses every month, not quarterly. This ensures you put aside enough money to cover these expenses.

Getting Information To Make Decisions

Pretend that your business is an aeroplane and you are the pilot. Without the right financial information of your business at hand, you are that pilot but blindfolded.

Generally, a plane can run efficiently on autopilot. This may be fine while everything is running smoothly – but you won’t see that red light on your dashboard telling you something is wrong.

As a business owner, you need the right information at the right time, so you can take action to fix problems before it’s too late.

The Process

REQUEST A CALL BACK

REQUEST A

CALL BACK

Would you like to speak with an experienced consultant over the phone? Submit your details and we’ll be in touch shortly. You can also email us if you would prefer.