CASH FLOW ANALYSIS

The key to a healthy business is knowing exactly where your money has gone and, more importantly, where it will go in the future.

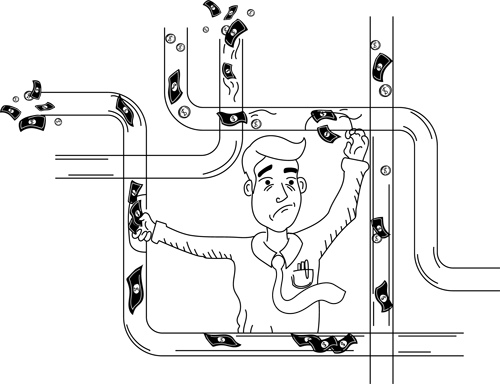

As your business grows, it becomes more complex and harder to keep track of cash flowing in and out. You may have a few good months of income but then receive a quarterly BAS and wonder where it all went.

You may even need an expensive cash flow loan to cover urgent bills. This loan eats into your future cash flow, which can add interest costs and late fees.

Financial Controlling @ Anconsult can prevent all this from happening by giving you complete understanding of your cash flow.

What happens when cash flow goes unchecked?

Cash flow in small business is very much equivalent to the movement in your bank account. As long as you have only one account, you can read it- if you have more, it will be more tricky.

Cash Flow Analysis is an outlook into your future cash outflow, so you don’t run dry when something important needs to be paid. Have you enjoyed a few months of positive inflow of money to receive your quarterly electricity bill and see your joy fly away?

Why You Need Cash Flow Analysis

You can’t wait for a quarterly report to find out that you’re running out of cash – just as you can’t wait until your car’s petrol gauge says ‘Empty’ before realising you need petrol.

Cash is the fuel of your business – you need to know how much you have at any moment. Then you’ll know your bills will be paid and you can make decisions about your business.

Our cash flow analysis gives you this information. It helps you keep track of your money, and measure your business’s health and sustainability.

REQUEST A CALL BACK

REQUEST A

CALL BACK

Would you like to speak with an experienced consultant over the phone? Submit your details and we’ll be in touch shortly. You can also email us if you would prefer.